Source: Tender Notice issued by the Board of Revenue (South Punjab), Government of The Punjab.

Public procurement, the process by which government entities acquire goods, services, and works, forms the backbone of public service delivery and economic activity. It is a critical function that demands transparency, efficiency, and fairness to ensure optimal utilization of taxpayer money and foster a healthy competitive environment among businesses. In this context, a recent “Tender Notice” issued by the Board of Revenue (South Punjab), Government of The Punjab, provides a pertinent example of public sector procurement in action, offering valuable insights into the procedures, requirements, and underlying principles governing such processes in Pakistan.

This post delves deep into the specifics of this tender notice, exploring its various components, the implications for potential bidders, and the broader significance of such procurement activities within the administrative framework.

Understanding the Essence of the Tender Notice

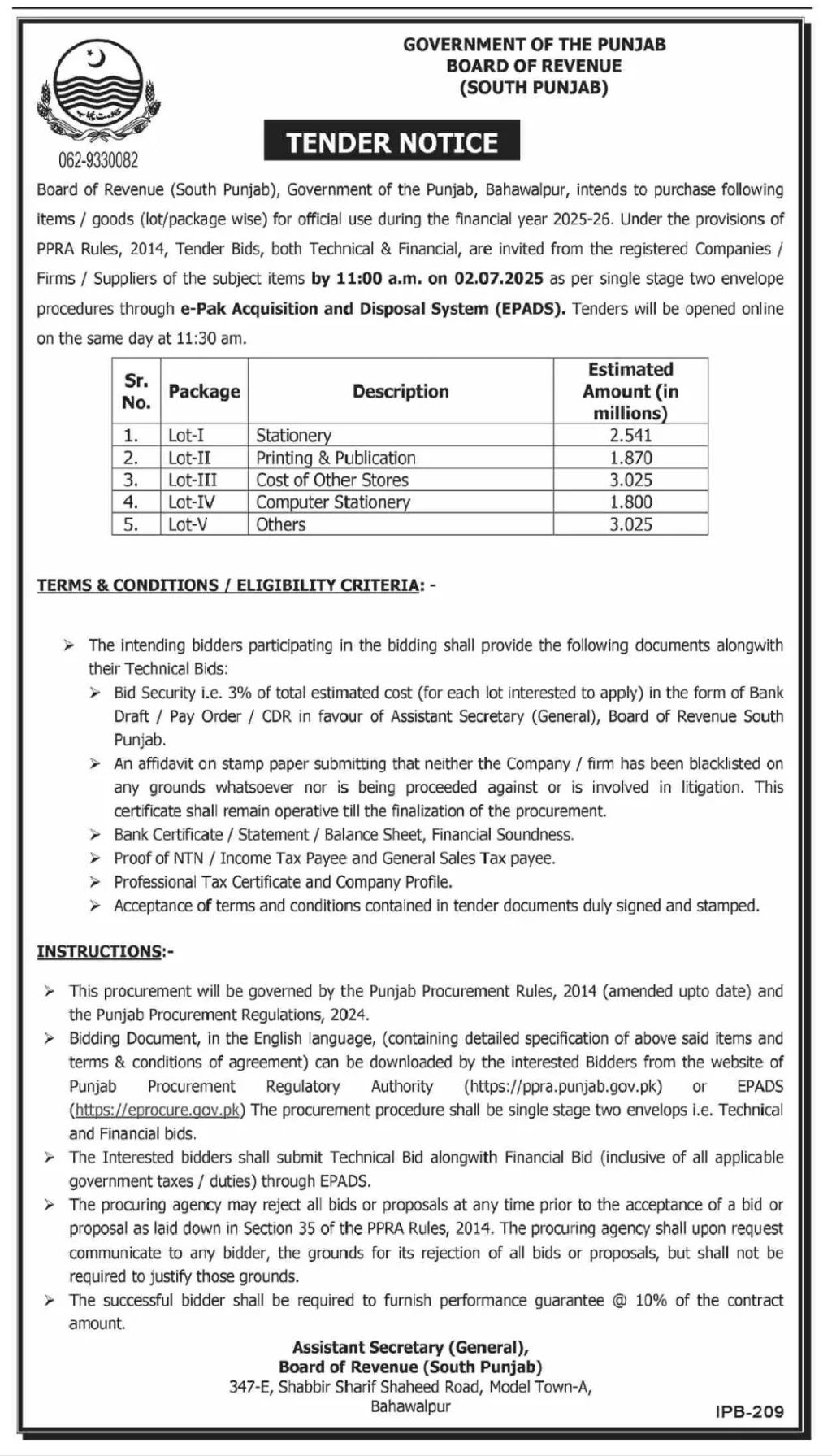

The tender notice, dated 062-9330082, clearly outlines the intention of the Board of Revenue (South Punjab), Bahawalpur, to purchase various items and goods for official use during the financial year 2025-26. This is a standard annual exercise for government departments, ensuring that they are adequately equipped to carry out their functions effectively. The procurement process is slated for 11:00 AM on July 2, 2025, when bids will be opened online via the e-Pak Acquisition and Disposal System (EPADS).

The Issuing Authority: The “Board of Revenue (South Punjab)” is a crucial administrative body responsible for land records, revenue collection, and related judicial matters within the southern region of Punjab, Pakistan. Its efficient functioning directly impacts the provincial government’s ability to collect taxes and manage land resources, making the procurement of necessary supplies vital for its daily operations.

The Purpose and Fiscal Year: The tender specifically aims to procure items for the fiscal year 2025-26. This highlights the forward-looking nature of public sector planning, where budgetary allocations and procurement needs are determined well in advance to ensure continuity of services. The items listed are essential operational supplies, ranging from basic office needs to more specialized computer accessories.

The Procurement Method: EPADS and Single Stage Two Envelope Procedure:

The tender specifies that bids will be received and opened through the “e-Pak Acquisition and Disposal System (EPADS).” This is a significant detail, indicating a move towards digitalization and automation in government procurement. EPADS is designed to streamline the bidding process, enhance transparency, and reduce human intervention, thereby minimizing opportunities for corruption and increasing efficiency.

Furthermore, the tender mandates a “Single Stage Two Envelope Procedure.” This method is commonly employed in public procurement to ensure fairness and objectivity. It involves bidders submitting two separate envelopes:

- Technical Bid: Contains details about the bidder’s technical capabilities, experience, adherence to specifications, and proposed methodology, but no pricing information.

- Financial Bid: Contains the financial proposal, i.e., the price quoted for the goods/services.

In the single-stage two-envelope procedure, the technical bids are opened first and evaluated based on predefined criteria. Only those bidders who qualify technically have their financial bids opened. This ensures that the evaluation of technical merit is not influenced by price, leading to the selection of technically competent suppliers at a competitive price.

Breakdown of Procured Items and Estimated Costs

The tender notice provides a breakdown of the items required, categorized into five lots, along with their estimated costs in millions of Pakistani Rupees:

- Sr. No. 1: Lot-I: Stationery (Estimated Amount: 2.541 million)

- This lot covers general office supplies like pens, paper, notebooks, files, etc. These items are fundamental for any administrative office’s day-to-day functioning.

- Sr. No. 2: Lot-II: Printing & Publication (Estimated Amount: 1.870 million)

- This includes printing services for official documents, forms, reports, and possibly publications related to revenue laws or land records. This is crucial for record-keeping and dissemination of information.

- Sr. No. 3: Lot-III: Cost of Other Stores (Estimated Amount: 1.025 million)

- This is a broader category that might include miscellaneous office equipment, cleaning supplies, or other general items not covered by specific categories. It provides flexibility for unforeseen needs.

- Sr. No. 4: Lot-IV: Computer Stationery (Estimated Amount: 1.800 million)

- With increasing digitalization, computer stationery (e.g., printer paper, toners/cartridges, CDs/DVDs, data storage devices) is indispensable for modern offices. This highlights the reliance on IT in current administrative practices.

- Sr. No. 5: Lot-V: Others (Estimated Amount: 3.025 million)

- This open-ended category allows for the procurement of items that might not fit neatly into the other classifications but are nonetheless necessary. It demonstrates a pragmatic approach to procurement planning, acknowledging that not all needs can be precisely predicted.

The total estimated cost across all lots is approximately 10.261 million PKR. This financial allocation underscores the government’s investment in maintaining operational efficiency.

Elaborating on Terms & Conditions / Eligibility Criteria

To ensure that only reputable and capable firms participate, the tender notice lays down stringent terms and conditions, along with eligibility criteria:

- Bid Security (Earnest Money): “Bid Security i.e. 3% of total estimated cost (for each lot interested to apply) in the form of Bank Draft / Pay Order / CDR in favour of Assistant Secretary (General), Board of Revenue South Punjab.”

- Purpose: This is a standard requirement to deter frivolous bidding and ensure that only serious and financially capable bidders participate. It acts as a guarantee that the bidder will honor their commitment if their bid is accepted. If a bidder withdraws their bid prematurely or fails to sign the contract after acceptance, this security can be forfeited.

- Affidavit on Stamp Paper regarding Blacklisting: “An affidavit on stamp paper submitting that neither the Company / Firm has been blacklisted on any grounds whatsoever nor is being proceeded against or is involved in litigation. This certificate shall remain operative till the finalization of the procurement.”

- Purpose: This clause is critical for maintaining integrity in public procurement. It ensures that firms with a history of malpractice, default, or legal disputes with government entities are excluded. This protects the public sector from potential risks and ensures that contracts are awarded to trustworthy parties. The requirement for it to be operative until finalization means the bidder must remain clear of such issues throughout the process.

- Proof of Financial Soundness: “Bank Certificate / Statement / Balance Sheet, Financial Soundness.”

- Purpose: This criterion assesses the financial health and capacity of the bidding firm. It ensures that the company has the necessary financial resources to fulfill the contract obligations. A financially unstable company might struggle to deliver on time or meet quality standards, leading to disruptions in government services. This helps in risk mitigation for the procuring agency.

- Tax Compliance: “Proof of NTN / Income Tax Payee and General Sales Tax payee.”

- Purpose: This is a fundamental requirement demonstrating compliance with national tax laws. Only registered taxpayers are eligible to participate, promoting legal business practices and contributing to the national exchequer. It ensures that the government is dealing with legitimate businesses.

- Professional Tax Certificate: “Professional Tax Certificate and Company Profile.”

- Purpose: Professional Tax is levied by provincial governments on professions, trades, and callings. Its requirement indicates compliance with provincial tax obligations. The “Company Profile” provides an overview of the firm’s history, organizational structure, experience, and key personnel, allowing the procuring agency to assess its overall capability and relevance to the tender.

- Acceptance of Terms: “Acceptance of terms and conditions contained in tender documents duly signed and stamped.”

- Purpose: This ensures that bidders fully understand and agree to all the clauses, specifications, and requirements outlined in the tender documents. It creates a legally binding commitment to adhere to the specified terms if the bid is successful.

Detailed Instructions for Bidders

The instructions section further elaborates on the procedural aspects and legal framework:

- Punjab Procurement Rules 2014 (PPR 2014): “This procurement will be governed by the Punjab Procurement Rules, 2014 (amended upto date) and the Punjab Procurement Regulations, 2024.”

- Significance: The PPR 2014 provides the legal and regulatory framework for all public procurement activities within Punjab. Adherence to these rules ensures transparency, fairness, accountability, and efficiency in the procurement process. It minimizes discretionary powers and promotes competitive bidding. The mention of “amended upto date” and “Regulations, 2024” indicates continuous updates to ensure the framework remains robust and relevant.

- Bidding Document Availability: “Bidding Document, in the English language, (containing detailed specification of above said items and terms & conditions of agreement) can be downloaded by the interested bidders from the website of Punjab Procurement Regulatory Authority (https://ppra.punjab.gov.pk) or EPADS (https://eprocure.gov.pk).”

- Accessibility: Making the bidding documents available online through both PPRA and EPADS websites significantly enhances accessibility for potential bidders. This promotes wider participation and competition, leading to better value for money for the government. The specification of the English language ensures clarity for all participants.

- Submission Method: “The procurement procedure shall be single stage two envelops i.e. Technical and Financial bids.”

- Reinforcement: This reiterates the use of the single-stage two-envelope procedure, emphasizing the separation of technical and financial evaluations.

- Submission through EPADS: “The interested bidders shall submit Technical Bid alongwith Financial Bid (inclusive of all applicable government taxes / duties) through EPADS.”

- Digital Mandate: This explicitly requires online submission via EPADS, reinforcing the government’s push for digital procurement. Submitting through EPADS ensures a timestamped record, security of bids, and standardized submission format, reducing errors and processing time. The inclusion of “all applicable government taxes / duties” in the financial bid ensures that the quoted price is comprehensive and avoids later disputes.

- Right to Reject Bids: “The procuring agency may reject all bids or proposals at any time prior to the acceptance of a bid or proposal as laid down in Section 35 of the PPRA Rules, 2014. The procuring agency shall upon request communicate to any bidder, the grounds for its rejection of all bids or proposals, but shall not be required to justify those grounds.”

- Legal Provision: This clause is crucial as it grants the procuring agency the right to reject bids based on reasons specified in the PPRA Rules. While the agency must communicate the grounds for rejection upon request, the “not be required to justify” part might seem contradictory but usually refers to not needing to enter into a prolonged debate or disclose sensitive internal deliberations beyond the specified rule violation. This power is intended to protect the procuring agency from accepting unsuitable bids but must be exercised judiciously to avoid arbitrary decisions.

- Performance Guarantee: “The successful bidder shall be required to furnish performance guarantee @ 10% of the contract amount.”

- Ensuring Fulfillment: This is another standard financial safeguard. Once a bidder is awarded the contract, they must provide a performance guarantee (typically a bank guarantee) equivalent to 10% of the contract value. This ensures that the successful bidder completes the contract as per the agreed terms and conditions. If the contractor fails to perform or breaches the contract, the procuring agency can encash this guarantee to recover damages or cover additional costs.

Broader Implications and Significance

This tender notice, while specific to the Board of Revenue (South Punjab), reflects broader trends and principles in public procurement within Pakistan:

- Commitment to Transparency and Accountability: The reliance on the PPRA Rules and EPADS underscores a commitment to transparent and accountable procurement processes. By digitalizing submissions and mandating clear eligibility criteria, the government aims to reduce discretionary practices and ensure fair competition.

- Economic Impact and Support for Businesses: Public procurement provides significant opportunities for businesses, especially Small and Medium Enterprises (SMEs), to engage with the government. By procuring essential goods, the government stimulates economic activity and supports local suppliers, provided they meet the stringent requirements.

- Efficiency through Digitalization: The emphasis on EPADS signifies a move towards greater efficiency in government operations. Digital systems reduce paperwork, accelerate processing times, and make the entire procurement cycle more manageable.

- Ensuring Quality and Reliability: The detailed eligibility criteria, particularly those related to financial soundness and the absence of blacklisting, are designed to ensure that the government contracts with reliable and capable suppliers. This minimizes the risk of substandard goods or services, which could impact public service delivery.

- Fiscal Prudence: The specification of estimated costs and the requirement for performance guarantees highlight the government’s commitment to fiscal prudence and risk management in its spending.

Conclusion

The Tender Notice from the Board of Revenue (South Punjab) is more than just a request for bids; it is a microcosm of modern public sector governance. It illustrates the government’s efforts to enhance transparency, streamline operations through digitalization (EPADS), ensure financial integrity, and adhere to established regulatory frameworks like the Punjab Procurement Rules 2014. For businesses, it represents a structured opportunity to contribute to public service while operating within a clearly defined and regulated environment. Understanding the intricacies of such notices is crucial for both government entities ensuring effective governance and private sector players seeking to participate in national development initiatives. As Pakistan continues its journey towards greater digital integration and economic stability, robust and transparent procurement processes like this will play an increasingly vital role.