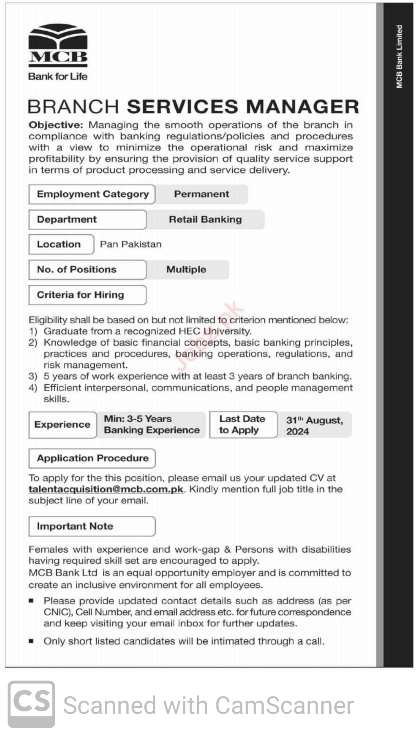

MCB Services Manager in Pakistan

MCB Bank Limited, one of the leading banks in Pakistan, plays a pivotal role in the country’s banking sector by providing a comprehensive range of financial services to individuals, businesses, and corporations. The success of MCB Bank is significantly driven by its dedicated and skilled workforce, among whom the Branch Services Manager (BSM) holds a crucial position. This post explores the role and responsibilities of an MCB Branch Services Manager in Pakistan, highlighting the skills required, career prospects, and the impact of this position on the bank’s operations and customer service.

Understanding the Role of a Branch Services Manager

A Branch Services Manager at MCB Bank is primarily responsible for overseeing the efficient operation of a bank branch. This role involves managing the daily activities of the branch, ensuring compliance with banking regulations, maintaining high standards of customer service, and leading the branch staff to achieve their performance goals. The BSM serves as a liaison between the branch and the head office, ensuring that the branch operates in alignment with the bank’s overall strategies and objectives.

Key Responsibilities of a Branch Services Manager

- Customer Service Excellence:

The BSM is the face of the bank at the branch level, and customer satisfaction is a top priority. The manager ensures that all customer interactions are handled professionally and that customers receive prompt and efficient service. This includes addressing customer complaints, resolving issues, and providing information about the bank’s products and services. - Operations Management:

Managing the day-to-day operations of the branch is a core responsibility. This involves supervising cash handling, overseeing account opening processes, ensuring the accuracy of transactions, and maintaining security protocols. The BSM ensures that the branch complies with all banking regulations and internal policies. - Staff Management:

The BSM is responsible for leading and motivating the branch staff. This includes recruiting, training, and evaluating employees to ensure they meet performance standards. The manager fosters a positive work environment, promotes teamwork, and encourages professional development. - Sales and Business Development:

The BSM plays a crucial role in driving the branch’s sales targets. This involves identifying opportunities for cross-selling bank products and services, developing strategies to attract new customers, and retaining existing ones. The manager collaborates with the sales team to achieve the branch’s financial goals. - Compliance and Risk Management:

Ensuring compliance with regulatory requirements and managing operational risks are critical aspects of the BSM’s role. The manager implements policies and procedures to mitigate risks, conducts regular audits, and ensures that the branch adheres to anti-money laundering (AML) and know-your-customer (KYC) guidelines. - Financial Reporting:

The BSM is responsible for preparing and analyzing financial reports related to the branch’s performance. This includes monitoring key performance indicators (KPIs), managing budgets, and reporting financial results to the head office. Accurate financial reporting is essential for informed decision-making and strategic planning.

Skills and Qualifications Required

To excel as a Branch Services Manager at MCB Bank, candidates must possess a combination of technical knowledge, leadership skills, and customer service expertise. Key qualifications include:

- Educational Background:

A bachelor’s degree in finance, business administration, or a related field is typically required. Advanced degrees or certifications in banking and finance can be an added advantage. - Banking Experience:

Significant experience in the banking sector, particularly in branch operations and customer service, is essential. Prior experience in a managerial role is highly desirable. - Leadership and Management Skills:

The ability to lead and motivate a team is crucial. Strong leadership skills, including effective communication, conflict resolution, and decision-making abilities, are required to manage branch staff successfully. - Customer Service Orientation:

A strong focus on customer satisfaction and the ability to handle customer issues with professionalism and empathy are vital. The BSM must be adept at building and maintaining customer relationships. - Analytical and Problem-Solving Skills:

The ability to analyze financial data, identify trends, and make informed decisions is important. Problem-solving skills are necessary to address operational challenges and improve branch performance. - Regulatory Knowledge:

An in-depth understanding of banking regulations, compliance requirements, and risk management practices is essential to ensure that the branch operates within legal and regulatory frameworks.

Career Prospects and Advancement

The role of a Branch Services Manager at MCB Bank offers promising career prospects. Successful BSMs can advance to higher management positions within the bank, such as Regional Manager, where they oversee multiple branches, or senior roles in the head office, including positions in operations, compliance, or business development.

MCB Bank invests in the professional development of its employees through training programs, workshops, and career development initiatives. This commitment to employee growth ensures that BSMs have the opportunity to enhance their skills, gain valuable experience, and progress in their careers.

Impact on Bank Operations and Customer Service

The Branch Services Manager plays a pivotal role in ensuring the smooth operation of the branch and maintaining high standards of customer service. By effectively managing branch activities, the BSM contributes to the overall success of the bank. Key impacts include:

- Enhanced Customer Experience:

By prioritizing customer service, the BSM ensures that customers have positive experiences at the branch. Satisfied customers are more likely to remain loyal to the bank and recommend its services to others. - Operational Efficiency:

Effective management of branch operations leads to increased efficiency, reduced errors, and streamlined processes. This improves the overall productivity of the branch and contributes to the bank’s profitability. - Risk Mitigation:

By implementing robust compliance and risk management practices, the BSM helps protect the bank from potential legal and financial risks. This ensures the branch operates within regulatory guidelines and maintains the bank’s reputation. - Business Growth:

The BSM’s efforts in sales and business development drive the branch’s growth. By identifying new business opportunities and retaining existing customers, the manager contributes to the bank’s expansion and financial success.

Conclusion

The role of a Branch Services Manager at MCB Bank in Pakistan is multifaceted and impactful. From managing daily operations and ensuring regulatory compliance to driving customer satisfaction and business growth, the BSM is a key player in the bank’s success. With the right combination of skills, experience, and dedication, a career as a Branch Services Manager offers significant opportunities for professional growth and advancement within MCB Bank’s dynamic and evolving landscape. By embracing this role, individuals can make meaningful contributions to the bank’s mission of providing exceptional financial services and achieving sustainable growth.